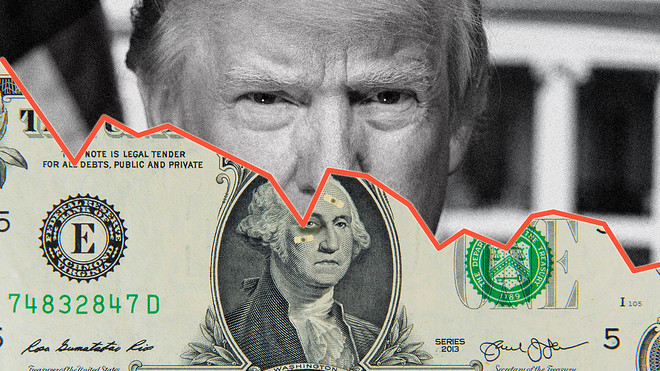

In recent years, the global financial landscape has witnessed a growing concern among economists, analysts, and geopolitical observers: Is Donald Trump killing the dollar? This provocative question has been at the center of debates, especially as Trump’s policies — both during and after his presidency — continue to influence the U.S. economy and global markets. Let’s dive into the roots of this concern, and examine whether it’s grounded in fact or fueled by speculation.

The Power of the Dollar

The U.S. dollar has long enjoyed the status of the world’s primary reserve currency. It is the backbone of international trade, a safe haven in times of crisis, and a key tool for U.S. geopolitical influence. However, that dominance is not guaranteed — it is upheld by trust in American institutions, economic stability, and strategic global alliances.

Trump’s Policies: America First, Dollar Last?

During his presidency (2017–2021), Trump launched a series of policies that, while popular with his base, raised eyebrows among economists:

- Trade Wars: The tariffs on China and other trading partners were intended to protect American industries. But they also triggered retaliatory tariffs and disrupted global trade. This not only caused uncertainty in markets but also made foreign investors wary of the U.S. economy.

- National Debt Explosion: Trump’s sweeping tax cuts, combined with increased military and infrastructure spending, pushed the U.S. national debt over $27 trillion by the end of his term. A high debt-to-GDP ratio can weaken confidence in the dollar over time.

- Attacks on the Federal Reserve: Trump frequently criticized the Federal Reserve, pressuring it to cut interest rates. Such political interference threatened the independence of the Fed, a cornerstone of investor trust.

- Isolationism and Broken Alliances: With an “America First” foreign policy, Trump pulled out of key global agreements and alienated traditional allies. This eroded America’s global standing — a critical component of the dollar’s strength.

The Aftermath: Dollar at Risk?

Even after leaving office, Trump’s influence remains strong. Talks of a second term bring uncertainty. His proposals to impose universal tariffs, weaken the Fed, and “de-globalize” trade could amplify fears among international investors. Countries like China, Russia, and even Saudi Arabia have accelerated efforts to de-dollarize their economies, building alternative systems and boosting gold reserves.

Moreover, Trump’s flirtation with economic nationalism and his growing distrust of global institutions could set the stage for a more fragmented financial world — one where the dollar no longer reigns supreme.

Are We Overreacting?

While concerns are legitimate, the dollar’s demise is far from imminent. The U.S. still commands the largest and most liquid financial markets in the world. There is still no viable alternative to the dollar on a global scale — not the euro, not the yuan, and not Bitcoin.

Still, perception is powerful. A second Trump presidency could stoke volatility, shake investor confidence, and accelerate moves toward alternative currencies. If enough countries and corporations lose faith in U.S. economic stability, the dollar’s dominance could slowly erode — not with a crash, but with a gradual shift.

Conclusion: A Warning, Not a Verdict

Is Donald Trump killing the dollar? That may be an exaggeration. But his policies, rhetoric, and vision for America certainly pose risks to the dollar’s long-term strength. The real danger lies not in a single president’s term, but in a pattern of governance that undermines institutions, global cooperation, and fiscal responsibility.

In the end, preserving the dollar’s status requires more than economic might — it demands trust, stability, and global leadership. Whether Trump can offer that — or continues to challenge it — remains a defining question for America’s financial future.